Stan Clawson was 20 years old when a rock climbing accident severed his spinal cord and left him paralyzed. Now 49, the Utah native and independent filmmaker relies on the insurance he gets through the Affordable Care Act health insurance marketplace for his medical needs.

“Unlike a lot of people who are lucky enough to just get health insurance as a ‘just in case,’ I use my health insurance every single day, multiple times a day, every time I go to the bathroom,” Clawson said during a recent interview, referring to his coverage for catheters. “For me, it’s not an option to not have health insurance. I need that just to live.”

Clawson is among the thousands of Utahns who — despite having higher incomes — pay less toward their monthly premiums because the federal government pays a subsidy toward the cost.

The subsidies, called enhanced premium tax credits, passed in 2021 and made it possible for people making more than 400% of the federal poverty level — just over $62,000 for an individual — to qualify for Affordable Care Act tax credits. People estimate what they’ll earn in the coming year and get the subsidies up front.

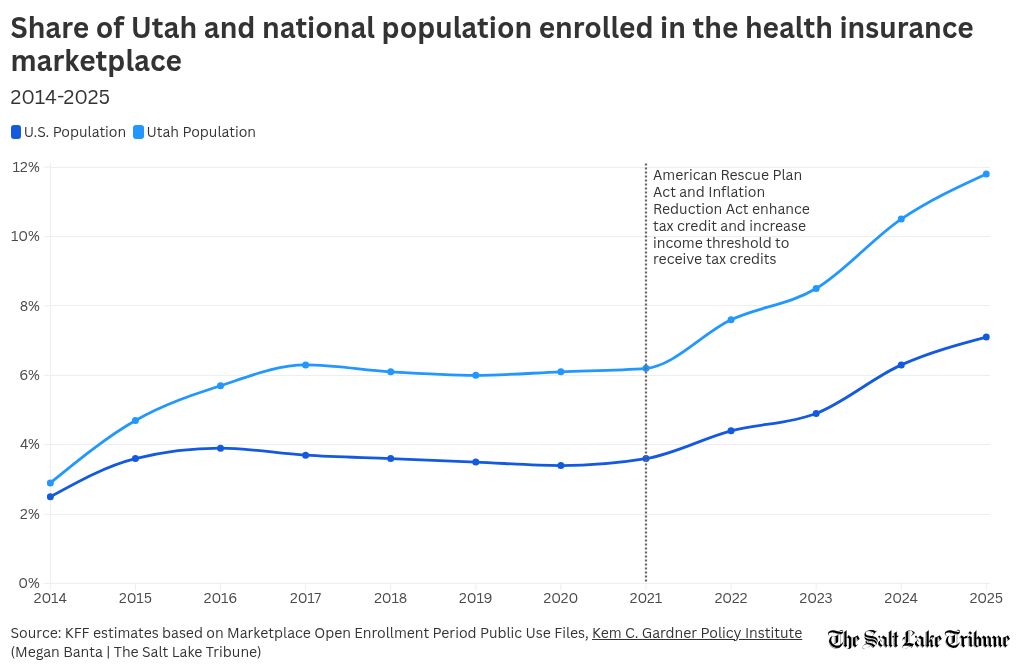

The expanded credits prompted the number of people getting health care coverage through the marketplace to more than double in Utah and across the country, but they’re set to expire at the end of the year.

If that financial assistance ends, Clawson’s health insurance premiums would more than double.

“As I read the news, I — and many others, I’m sure — am really living in a state of fear,” Clawson said. “[There is] nervousness about the future and of what our costs will be. It’s scary.”

Democrats are citing those higher costs as they refuse to agree on a seven-week funding deal that would reopen the government — unless the deal extends the enhanced credits and restores health care funding cuts passed earlier this year.

Most Republicans in Congress don’t want to keep the enhanced credits long term — but some members of Utah’s delegation say they’re open to discussing how to taper them down over time.

“I’ll never say I’m not willing to negotiate,” Rep. Blake Moore of Utah’s 1st Congressional District said during a recent interview. But, he said, he feels that expanding the tax credits beyond 400% of the poverty level was a mistake.

More than 10% of Utahns enrolled

Utah has the fourth-highest share of its population enrolled in a marketplace plan, according to data from a report the Kem C. Gardner Policy Institute released last month.

The Beehive State is among six states with at least 10% of the population enrolled, joining Texas and four southeastern states.

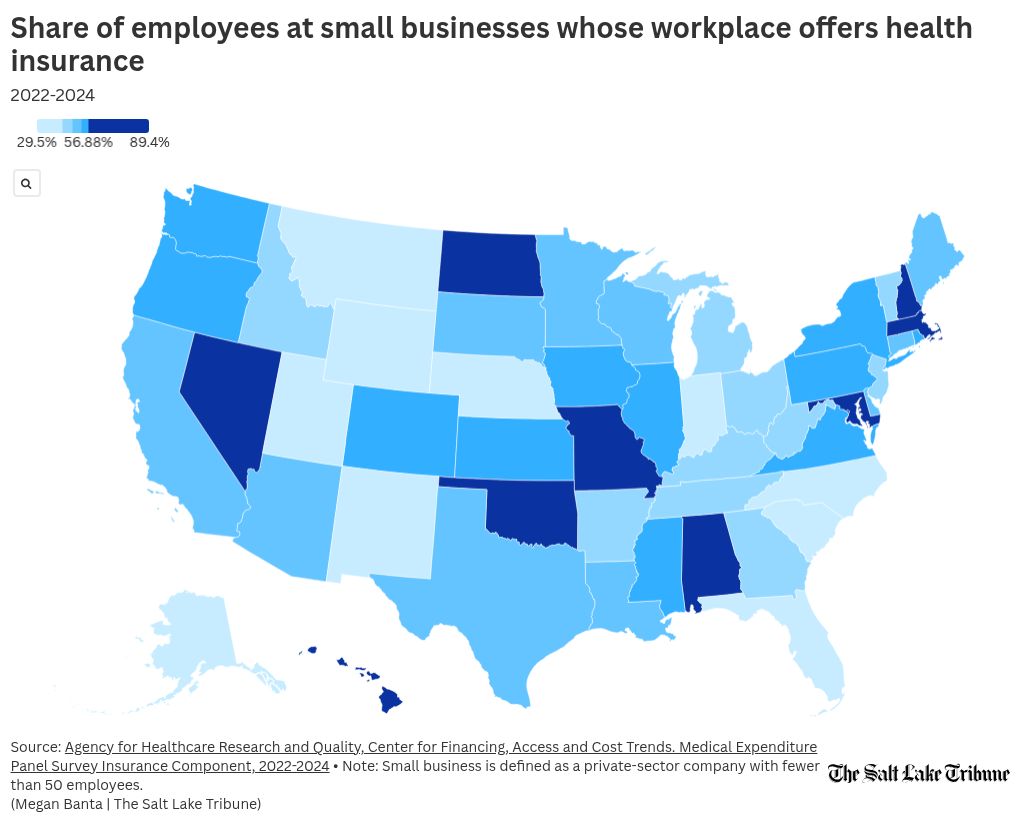

Utah also has a high number of small businesses, meaning companies with fewer than 50 full-time employees. Those businesses are not required to provide health insurance coverage to their employees, and many of them here don’t.

Utah is tied with Wyoming for the fourth-lowest share of employees working for small businesses that offer health insurance, according to data from the Agency for Health Research and Quality.

That means many employees of small businesses in Utah rely on the ACA for coverage — and the number has grown.

The number of Utahns enrolled in marketplace plans increased from 2014 to 2017, then stayed largely unchanged until 2021.

After the introduction of the enhanced credits in 2021, the number of Utahns covered more than doubled, and the share of the population enrolled jumped more than five percentage points, the Gardner Institute report says.

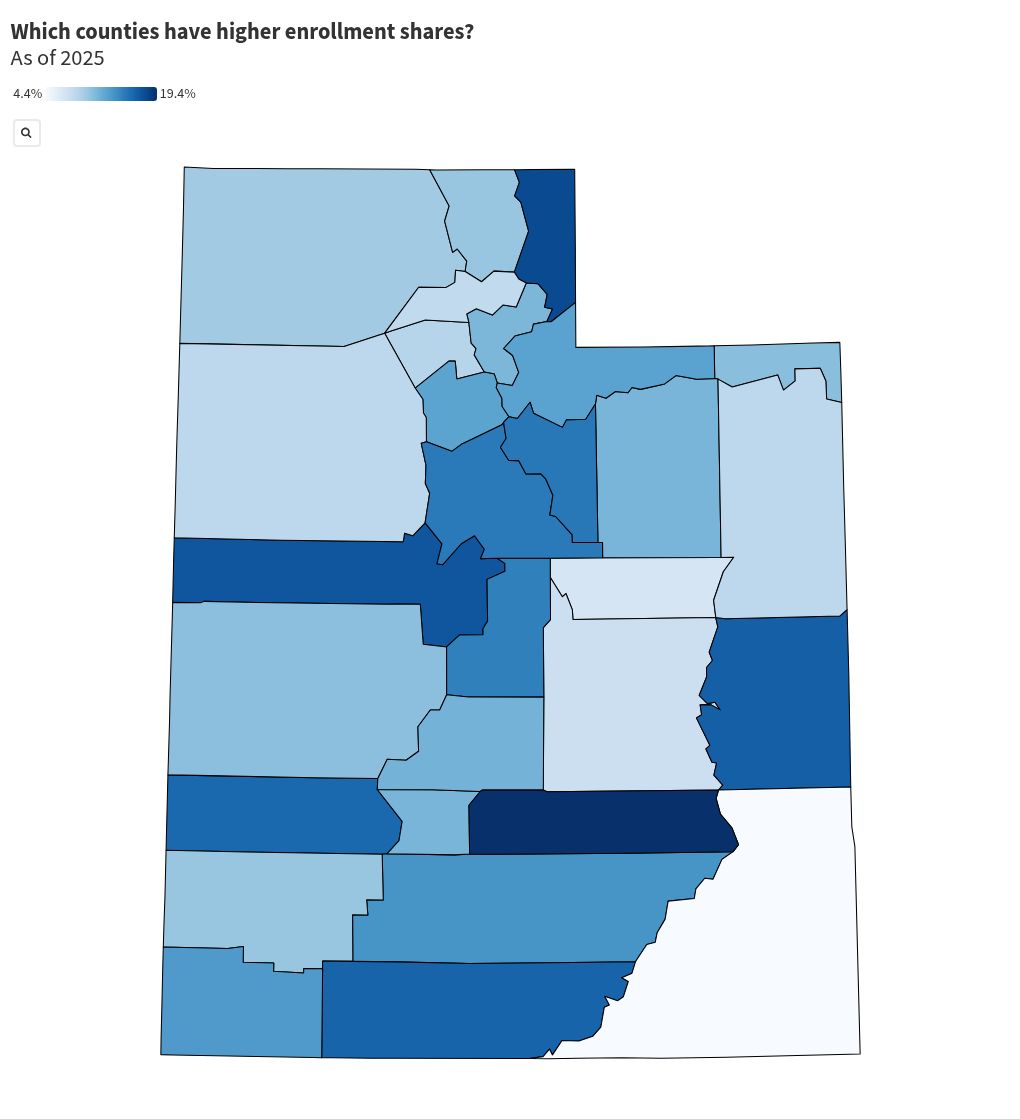

The largest jumps were in rural counties.

And though most Utahns enrolled in marketplace plans live along the Wasatch Front, rural counties like Juab, Rich and Wayne have larger portions of their population enrolled.

Broker says many Utahns could be priced out

The vast majority of Utahns enrolled – about 96% – receive the tax credit for people who make between 100% and 400% of the federal poverty level. That differs from the enhanced credit that is set to expire.

A much smaller portion – about 7% – of those enrolled have incomes that are higher than 400% of the federal poverty level, meaning they qualify only for the enhanced premium tax credit.

In both cases, people get the money up front based on what they think they’ll earn in the coming year. If they earn more than expected, they may need to repay the government at tax time. If they earn less, they may owe less in taxes.

The average premium tax credit amount in Utah is $463. That’s one of the lowest in the nation and in line with neighboring states like Colorado, Nevada and Arizona.

But losing that could still have dire financial consequences for Utahns like Clawson.

Currently, Clawson pays $334.95 per month for his health insurance. The $382 enhanced premium tax credit he receives covers the rest of the cost of his monthly premium, but if the credits expire, his monthly health insurance costs will more than double, forcing him to pay some $726 a month.

While Clawson said he has to have health insurance, Charlie Kulander expects many others will become uninsured because they’ll get priced out.

(Chris Samuels | The Salt Lake Tribune) Stan Clawson is photographed in his office in Salt Lake City, Thursday, Oct. 9, 2025. Clawson, a freelance filmmaker, uses the Affordable Care Act for health care coverage for his spinal cord injury.

Kulander, a Moab resident, credits the ACA for saving his family from bankruptcy. He and his late wife were diagnosed with cancer in 2009, when he says the country was still in the “dark ages of health insurance.”

They couldn’t switch insurance providers because of their pre-existing conditions, and premiums got “outrageously expensive,” he said, to the point they were putting premiums and out-of-pocket medical expenses on credit cards.

“It ate up all our life savings,” he said, until the ACA made it possible for them to get affordable health care again.

Kulander, who has since aged into Medicare, became certified to help people navigate the health insurance marketplace. Then he became an insurance broker and has a “pretty large stable of clients,” most of whom are lower-income service workers at small businesses.

Several of his clients are worried, he said, and with good reason.

A middle-tier ACA plan this year costs between $1,400 and $1,600 a month, he said, but subsidies covered all but about $400 of that. Without the enhanced premiums, he said, people making more than $62,600 will pay full price — and he’s not sure how they’ll do it.

“If we go back to those same old subsidies that we had, we’re going to lose an awful lot of people off the ACA,” Kulander said.

The Utah Health Policy Project is calling on Congress to make sure that doesn’t happen, especially as health care costs rise.

“Congress must act to ensure that all Utahns can afford the care they and their families need,” the organization said in a statement.

‘Very interested in that debate’

Congressional Democrats are pushing to keep the enhanced credits permanently as a condition of funding the government. Some members of Utah’s all-GOP federal delegation say they’re willing to discuss an extension — if that conversation is separated from the fight over the government shutdown.

“I’m very interested in that debate and discussion,” Rep. Mike Kennedy, who represents the 3rd Congressional District, told reporters earlier this month.

Kennedy, a physician, said he was concerned about having federal funding that just dropped off a cliff, and laid the blame for the expiration of the tax credits at the feet of Democrats, who were in the majority when the expansion was initially passed.

“Those enhanced premium tax credits were programmed by the Democrats to end on December 31 this year,” he said. “They just dropped it right off.”

“I think there’s a way for us to [develop a] glide path to those [ending] and it’s something that we should talk about,” he added.

But not, he said, “with the government held hostage and the American people held hostage, with their government shutting down as a result.”

Moore made similar comments in an interview this month, and further argued that the enhanced subsidies are contributing to rising health care costs.

“The more we subsidize them, the more that there’s no pressure — there’s no market pressure — to constrain these costs of premiums, and that’s a big concern for me,” he said.

(Bethany Baker | The Salt Lake Tribune) Republican Rep. Blake Moore, pictured here speaking on election night in 2024, said in an interview with The Salt Lake Tribune that the enhanced subsidies are contributing to rising health care costs.

“So if we just continue on with these subsidies, and we don’t see insurance premiums go down,” Moore continued, “we’re going to create more debt, and the health care costs will continue to go up.”

Moore also said he was frustrated that Democrats had made the tax credits part of the messaging about the government shutdown, when health care funding is not part of the appropriations bills currently under debate.

“When we talk about a shutdown, we’re talking about 12 specific appropriations bills,” he said. “None of them dictate what goes on with the Affordable Care Act. … You can’t solve [the] Obamacare debate discrepancy within an appropriations bill. They’re two completely separate buckets of funding.”

Rep. Celeste Maloy of the 2nd Congressional District agreed.

Spokespeople for Rep. Burgess Owens and Sens. Mike Lee and John Curtis did not respond to requests for comment on whether they were open to an extension of the tax credits and the impact on their constituents if the credits expire.

Clawson said he is frustrated that he doesn’t see a wider discussion about the credits, even as the fight over them has become political.

It should be “a unifying, nonpartisan issue,” he said, adding that he knows many Republicans and independents who benefit from the enhanced premium tax credits.

“What scares me is that the only people talking about it are the Democrats,” he said. “I’m just like, are people just not aware that that’s happening?”

Megan Banta is The Salt Lake Tribune’s data enterprise reporter, a philanthropically supported position. The Tribune retains control over all editorial decisions.